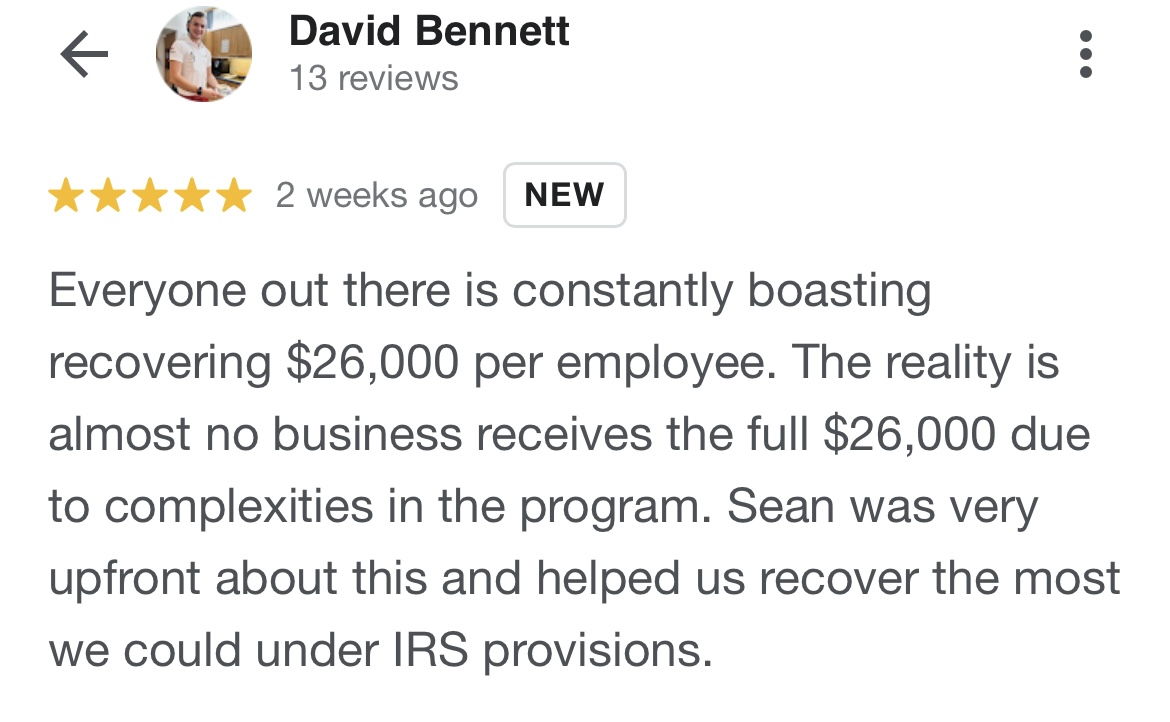

Discover How Businesses are Qualifying For Federal IRS Refund Checks Up To $26,000 (Per W-2 Employee)

Discover How Businesses are Qualifying For Federal IRS Refund Checks Up To $26,000 (Per W-2 Employee)

The IRS Estimates That Only 18% of Businesses That Qualify Are Actually Applying For The Employee Retention Credit!

The IRS Estimates That Only 18% of Businesses That Qualify Are Actually Applying For The Employee Retention Credit!

*IMPORTANT: These ERC refunds never have to be forgiven or paid back. (And almost everyone we’ve spoken with who was told by an advisor that they didn’t qualify, actually DOES qualify under the current criteria). That said, there has been A LOT of confusion about how the program actually works since the law changed 5 times in the past year (details below).

*IMPORTANT: These ERC refunds never have to be forgiven or paid back. (And almost everyone we’ve spoken with who was told by an advisor that they didn’t qualify, actually DOES qualify under the current criteria). That said, there has been A LOT of confusion about how the program actually works since the law changed 5 times in the past year (details below).

Less Hassle. Less Stress.

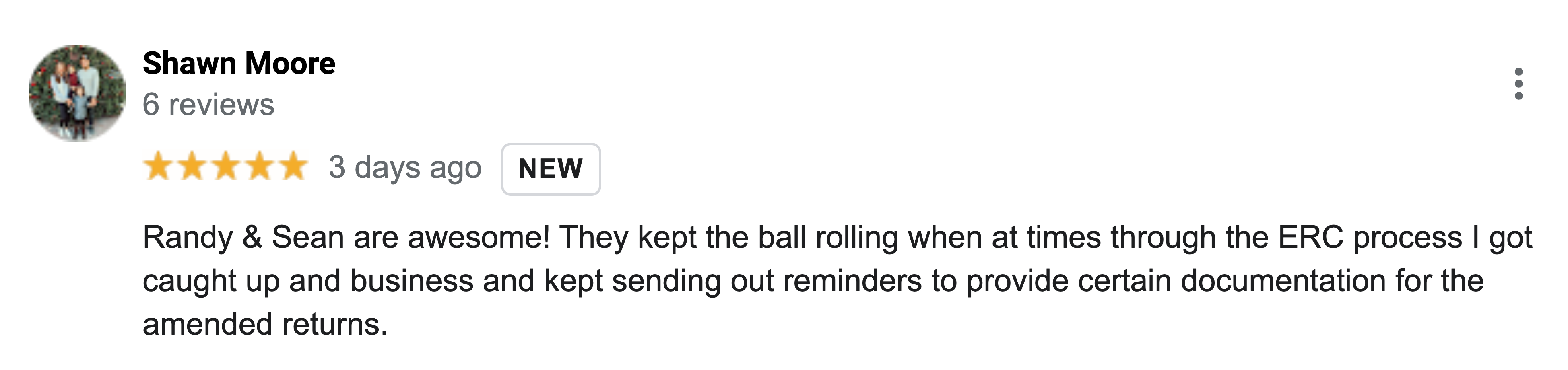

We Made The ERC Process Easy For You...

1. A risk-free, no-cost assessment. Most Businesses Qualify.

2. We help you collect the data needed for qualification.

3. We calculate the maximum refund possible.

4. We file your claim on your behalf directly with IRS.

5. Your Business Receives a Check Directly from IRS.

6. We provide audit defense & protection for your claim.

From The Desk Of Sean Conroy:

ERC is a once-in-a-lifetime opportunity for your business.

This is, without a doubt, the single greatest tax refund opportunity the US Government has ever made available to businesses.

We don’t know exactly when the Government will shut it down, but we know we have a limited time to make the most of this opportunity… And so do you! I hope you will take advantage of this amazing opportunity!

Your ERC Questions Answered!

I received a PPP loan, am I disqualified?

You can still qualify for an ERC refund check, even if you had a PPP or PPP-2 loan. While the CARES Act originally prohibited having both an ERC and a PPP loan, the stimulus legislation recently passed (Consolidated Appropriations Act of 2021) eliminated this prohibition retroactive to March 13, 2020. Your business can now have both a PPP loan and ERC refund, however, special calculations around payroll wages and attribution is required. Enroll ERC provides these calculations and all required schedules as part of a professional engagement.

What constitutes a partial suspension of operations?

A partial suspension of operations can take many forms. Here are some common examples we see in businesses like yours:

- unable to attend trade shows in-person (“travel or group meetings”)

- had staff go from in-office to work-from-home and had an impact

- retail or restaurant that reduced the number of customers allowed inside

- closed down a department or business unit while other units continued to operate

There are many ways businesses fully or partially suspend operations during each calendar quarter, and we help you document this as part of an engagement.

I did not have a revenue reduction, am I disqualified?

If your business had to change operations due to governmental orders or if gross receipts declined by 20%, your business likely qualifies. A change in operations could mean extra cleaning or sanitizing, limiting capacity or reducing hours, installing/utilizing protective equipment, temperature checks, or operational impact related to key suppliers or customers. For example, a law firm may have no longer been able to do in-person court hearings or in-person depositions, and cases may have been delayed, even if the firm continued to operate.

Does The ERC Apply to Nonprofits?

Yes. Examples of nonprofit organizations that have already taken advantage of the credit are hospitals, schools, museums, performing arts centers, and churches.

How long does it take?

Our Experts usually take 1-2 weeks to process your payroll, reconcile any PPP covered period overlap, and build out the attribution schedules. We will then file your forms with the IRS who will take between 8-12 weeks to process your tax credit and send you a check.

Will the ERC funds run out?

This is not a lending program - tax refunds are issued by the US Treasury. Therefore, all eligible employers will receive the funds.

Do I Have To Repay The ERC Credit?

No. This is not a loan. It's a refundable tax credit. When we file your ERC claim we request a refund check for you.

Why can't my tax accountant handle this?

You don't see a general surgeon for a heart transplant.

Even though a general surgeon is technically licensed to perform a heart transplant - when you need the job done right the first time, by someone who is experienced and has focused their training on the most important thing for you in that moment . . . you see a cardiothoracic surgeon.

When you need income tax return preparation, you see a CPA who is experienced and focused on their continuing education in income taxes.

Just because your dental license permits you to offer orthodontics doesn't mean you should figure out how to treatment plan orthodontics in your spare time. And especially not when it is the only time you'll ever do it. And . . . "spare time" . . . really? Who has that?

The same can be said for the CPA that handles your income taxes. He or she most likely only prepares your Federal and State Income Tax Returns. However, ERTC credits are claimed against Employment Taxes on Form 941, which is often handled by your payroll service.

The complexity of the ERTC program is a beast unto itself and every tax accountant we’ve talked to has said they are focused on income taxes and "they'll figure this out later".

Let's face it, your CPA is already in a crunch for time getting returns prepared. They are short-staffed (like most businesses) and it will be many months before they have time to "figure this out".

Preserve your relationship with your CPA, avoid putting them in the awkward position of "is it done yet?" and let our ERTC experts get the job done right the first time, and quickly.

If I'm a large employer, is it worth still claiming the ERC?

Yes. While the definition of qualified wages is limited for large employers, you can still take advantage of the ERC if you paid employees that were either not working or were working reduced hours. Depending on the size of your company and the amount of qualified wages paid during the quarter, the ERC can still be substantial. For 2020, a large employer is more than 100 employees. For 2021, that threshold was increased to 500 employees.

Why shouldn't I let my payroll service handle this?

Your Payroll Service does an excellent job of executing the fundamentals of paying your employees, paying your employment taxes and filing your quarterly reports.

But computing your ERTC credits requires visibility into your P&L and PPP forgiveness applications. Not only that, but the complex requirements around eligibility and allocating ERTC credits at the employee-level while accounting for annual and quarterly qualifying wage caps and . . . well, you can probably tell why Payroll Services are not offering to do all of this for you.

The Payroll Services that we’ve worked with so far are happy to provide the payroll registers that we need to perform the allocations. And they are happy to file the Amended Form 941-X with the IRS on our client’s behalf.

But that’s the extent of it.

In fact, most Payroll Services are asking clients to sign an indemnification waiver before submitting a Form 941-X because the Payroll Service can take no responsibility for the accuracy of the ERTC credits you are claiming.

For them to involve themselves in the intricacies of this calculation, it is a liability and beyond their scope of services.

What is the deadline to file?

There are only two deadlines:

For all quarters in 2020, the deadline to apply for the ERC is April 15, 2024

For all quarters in 2021, the deadline is April 15, 2025.

If you want to maximize your refund, then your amended 941x’s need to be submitted by April 15, 2024.

The IRS states, “For purposes of the period of limitations, Forms 941 for a calendar year are considered filed on April 15 of the succeeding year if filed before that date.” This rule is derived from Section 6513 of the Code in which subsection (c) “Return and payment of Social Security taxes and income tax withholding,” includes the rule that, “(1) If a return for any period ending with or within a calendar year is filed before April 15 of the succeeding calendar year, such return shall be considered filed on April 15 of such succeeding calendar year.”

In simple terms, This means that while the Form 941 for the second quarter of 2020 was originally due on 7/31/2020; the third quarter was due on 10/31/2020; and the fourth quarter was due on 1/31/2021, all of those returns are considered filed on 4/15/2021, setting the three-year statute of limitations for amending any of those returns as 4/15/2024.

THESE ARE JUST A FEW OF THE REFUNDS WE'VE RECOVERED FOR CLIENTS....

THESE ARE JUST A FEW OF THE REFUNDS WE'VE RECOVERED FOR CLIENTS....

What could your business do with these types of refunds?

Veterinary Clinic

Received PPP - YES

Total ERC Refund: $780,000

Property Manager

Received PPP - YES

Total ERC Refund: $1,200,000

Food Distributor

Received PPP - YES

Total ERC Refund: $364,000

Commercial Painting

Received PPP - YES

Total ERC Refund: $600,000

Fabric Manufacturer

Received PPP - YES

Total ERC Refund: $2,200,000

AC Maintenance & Repair

Received PPP - YES

Total ERC Refund: $650,000

Daycare

Received PPP - YES

Total ERC Refund: $120,000

Hair Salon

Received PPP - YES

Total ERC Refund: $220,000

Pavement Contractor

Received PPP - YES

Total ERC Refund: $375,000

$1 Million Dollar ERC Refund? See For Yourself!

$1 Million ERC Refund? See For Yourself!

WARNING: ERC Refunds are only available until April 2024, and the IRS backlog is getting worse.

WARNING: ERC Refunds are only available for a limited time, and the IRS backlog is getting worse.

STOP Believing The Lies About The Employee Retention Credit!

STOP Believing The Lies About The Employee Retention Credit!

There's a bunch of ridiculous myths and out right lies out there that the media and CPA's want you to believe:

MYTH 1: A business that has already received Paycheck Protection Program (PPP) loans or had its PPP Loans forgiven, cannot claim ERC.

TRUTH: Businesses can utilize both programs! This limitation was removed in the Consolidated Appropriations Act (CAA) of 2021.

MYTH 2: A business did not have a drop in gross receipts of 50% or more and is therefore not eligible for ERC.

TRUTH: The IRS reduced the qualification from 50% to 20% for the first three quarters of 2021 OR the business can qualify with a partial suspension of operations due to State/Local/Federal shutdown mandates.

MYTH 3: A business did not shut down during the pandemic, so it is not eligible for ERC.

TRUTH: A business impacted by a partial shutdown, disruption to supply chain, vendor, or business operations, limited hours and capacity or had restricted access to equipment or experienced a significant decline in revenue, may still qualify for ERC.

MYTH 4: A business was deemed essential, so it does not qualify.

TRUTH: A business that experienced an impact or change to operations or a decline in revenue may still qualify for ERC

MYTH 5: A business must have fewer than 500 employees in order to be eligible for ERC.

TRUTH: A business’s employee count restriction is based on full-time equivalent (FTE) employees, rather than everyone in the workplace.

MYTH 6: A business had increased sales during the pandemic, so the business is not eligible for ERC.

TRUTH: Although a business has grown, it may still be eligible if it was impacted by a full or partial suspension of operations due to a governmental restriction.

MYTH 7: A business' sales rebounded in Q1 of 2021, so it is not eligible for ERC.

TRUTH: The (CAA) allows a business to determine its eligibility based on lost revenue in 2020 quarters or a suspension in operations.

MYTH 8: A not-for-profit cannot claim ERC.

TRUTH: Non-profit organizations such as non profit hospitals, churches, museums, etc. are eligible for ERC.

MYTH 9: The Employment Retention Credit Ended. It’s Too Late to Take Advantage

TRUTH: As long as the statute of limitations remains open, which is three years from the date of filing, you can still apply for ERC

Don't Assume That Your Industry Or Business Type Won't Qualify!

Don't Assume That Your Industry Or Business Type Won't Qualify!

Also, for those of you may have unsuccessfully applied before... Good News, the most recent legislation means you have a better chance of qualifying now.

Consulting

Franchises

Marketing

Hospitality

Retail

Gym Owners

IT

Pharmaceuticals

Technology

Law Firms

Financial Services

Construction

E-Commerce

Real Estate

Distributors

Coaches

Pension Plans

Insurance

Wholesaling

Utilities

Nail Salons

Dentists

Hospitals

Manufacturing

Agencies

Hairdressers

Gyms

Plus MANY More!

Want A More In Depth Look At ERC?

Want A More In Depth Look At ERC?

Watch This Webinar Below:

Watch This Webinar Below:

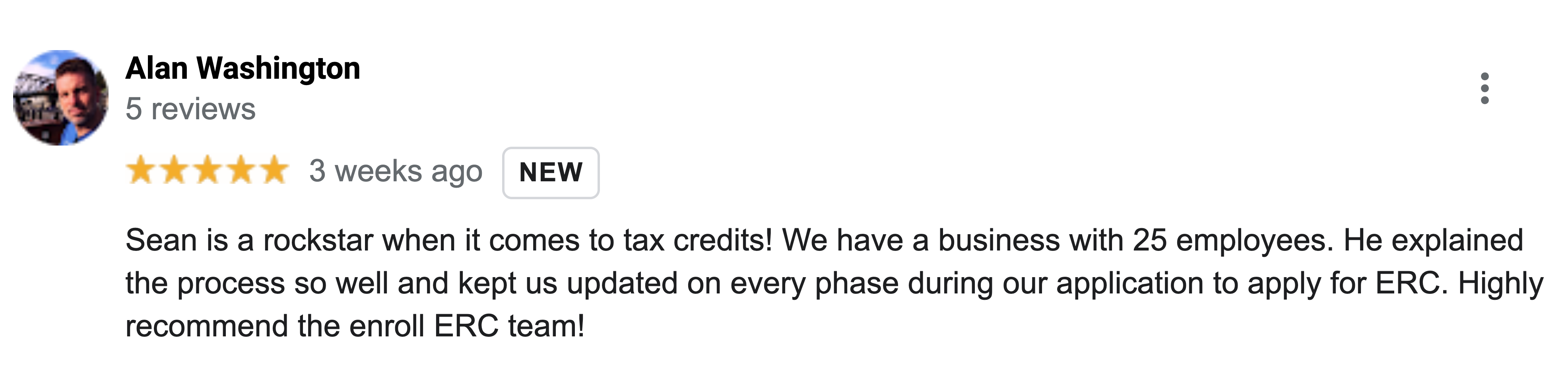

File With Confidence

Our tax attorneys and CPAs will work hard to verify your claim and uncover every credit your business is eligible to receive

- We don't get paid until your business gets paid

- Our independent tax attorneys will defend our work in case of audit

- We stand behind our work with $2m in audit protection

Support You Can Count On

Our team will guide you every step of the way, from eligibility to claiming & receiving refunds.

- Dedicated refund specialist assigned to your account

- Thourough evaluation regarding eligibility. We leave no stone unturned when check your business's eligibility

- After a full analysis, we aim to leave no question marks in your claim

EnrollERC LLC 2023

Alpharetta GA 30004

DISCLAIMER: All information shared should be considered the sole thoughts and opinions of the author(s). This content is for educational purposes and is not personalized financial, tax, investment or legal advice. EnrollERC LLC is a Third Party firm that assists its customers with Employee Retention Credit (ERC) filing services. This website is not affiliated with the Internal Revenue Service or any governmental organization. Any financial number referenced here, or on any of our sites, are illustrative of concepts only and should not be considered average earnings, exact earnings, or promises for actual or future performance. This site is not a part of the YouTube, Bing, Google or Facebook website; Google Inc, Microsoft INC or Meta Inc. Additionally, This site is NOT endorsed by YouTube, Google, Bing or Facebook in any way. FACEBOOK is a trademark of FACEBOOK, Inc. YOUTUBE is a trademark of GOOGLE Inc. BING is a trademark of MICROSOFT Inc.

Forbes Article Source: https://www.forbes.com/sites/deanzerbe/2022/02/15/employee-retention-credit---still-the-one-the-latest-update/?sh=385bd3ef51b8